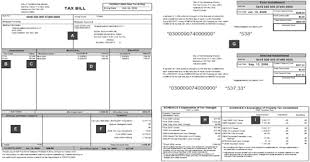

A - Property Identification

This section contains the identification information of your property. The information includes: roll number, group code (use for people with multiple properties), mortgage company and mortgage number (if your taxes are paid on behalf of you mortgage company), owner's name and mailing address and the property location and description.

B - Tax Class

This section lists the classification(s) of your property. The tax class codes are broken down by class, qualifier & education support. The class codes are either 3 or 4 alpha and/or numeric codes. These classifications are assigned by MPAC. Should you have a question regarding the classification you are encouraged to contact MPAC at 1-866-296-6722.

C - Value

This shows the current value of your property as assessed by the Municipal Property Assessment Corporation (MPAC).

D - Municipal/ Education Rates & Levies

This section provides a breakdown of your property taxes. The municipal tax rates are set by City Council while the Education Tax rates are set by the Province. The rates are multiplied by your assessment to provide the breakdown for each levy.

E - Special Charges / Credits

This section will list any charges or credits that are specific to your property. The charges could include local improvement charges such as water and sewer charges.

F - Summary

This section summarizes your total taxes levied (both municipal and education), your total special charges and credits and any capping adjustments (applicable only for commercial, industrial and multi-residential properties). The total amount due for your billing is also noted in this area. Information on the total yearly taxes can also be found in this section.

G- Payment Stubs

Payment stubs are to be submitted along with your payment. Payment can be made by mail, in person, at your financial institutions or via telephone banking or internet banking. If you are paying your taxes using the City's Pre-authorized Payment plans or your mortgage company is paying your taxes on your behalf, these stubs will not have any payments due and payable on them. They will indicate that you do not need to pay the bill and to keep the bill for income tax purposes.

H - Schedule 2

This area is used for Residential, Farm, Managed Forest and Pipeline properties. It shows the year over year change from the previous year to the current year comprised strictly to the actual taxes, excluding any special charges or credits. It further breaks down the difference in the municipal and education levy change.

I - Schedule 3

This area is used for the Commercial, Industrial and Multi-Residential property classes. It shows the current year's taxes levied amount and the current year's adjusted tax levied amount due to the provincially mandated capping program. It further breaks down the difference in the tax cap amount, municipal levy change and the education levy change.